To avoid being trapped in the delusionary thinking of self-proclaimed economic experts, we need to conceive new definitions for both deflation and depression. The conventional definition — using definitions from Investopedia.com — for deflation is a general decline in prices, often caused by a reduction in the supply of money or credit, while that for depression is a severe and prolonged downturn in economic activity, or to be more precise, an extreme recession that lasts two or more years. Though helpful, these definitions don't allude to the risk of the deflation morphing into a depression.

We need new definitions that instead of being descriptive, identify cause and effect. Deflation and depression are always caused by changes in supply and demand, not of goods or services but money, or to be exact, credit supply. Deflation then, under this new definition, is a steady shrinking of credit while depression is a drastic plunge in credit. Credit is like water; you can hold it back but only for a while. When credit wants to contract, it will do so even if you create tons and tons of new credit.

Deflation will inevitably lead to depression despite whatever measures taken to prevent depression. Like the Monopoly board game, the real life economic game under the current Wave 4 of the Kondratieff Wave will end because wealth circulation is seizing up. We've seen how policymakers are throwing everything to stave off deflation. The ECB and the BOJ are back with the same QE stuff, an attempt that's no better than throwing the kitchen sink. Einstein would've deemed it insanity: expecting different results by doing the same thing over and over again.

With the recent spate of plane crashes involving major loss of life, it's best that we choose a different analogy as a pattern to understanding deflation and depression. The water dam, another human creation that has led to major loss of life when disaster struck would be an appropriate substitute. Hopefully, mankind has learned enough from past dam failures to avoid repeating one in the future. But for economics, mankind is still in the dark ages, condemned to suffer calamity after calamity.

A dam's structure is made of concrete, that is, a mixture of cement, sand, water and aggregate. A chemical reaction that emits heat ensues when water is mixed with limestone in the cement. Because of the dam's massive structure, the huge amount of concrete cannot cool evenly. Unless a special cooling method is contrived, the uneven cooling would result in a cracked structure. Over time, the weakened dam would give in and burst.

Similarly, in economics, the capitalism structure has a major fault. It has no room for compassion. Capitalism, like the Monopoly game, is a game in which the players compete at a very intense level. With that kind of emotion, you don't have a feeling of compassion for your fellow competitors who have lost out. The winner's aim is to decisively trounce the losers, with no quarter given. What the winning players don't understand is it's just a game. You finish off your competitors at the expense of the game being stopped. "The goal is to win, but it is the goal that is important, not the winning," said Reiner Knizia, the German board game designer. To keep on winning, the game cannot end. You must give away your winnings to keep the game in perpetual motion.

Each Kondratieff Wave is like a water dam. Mankind has built four Kondratieff dams so far. Three have crumbled with the fourth soon to fall apart. Only one more dam, probably a small one replacing the current one, is left to be built. Because of the dam's structural fault, it keeps on failing, each failure inflicting major economic disaster on people's lives. Unlike a water dam's disaster, you can't see the rushing water that lays waste to anything that lies in its path. It's not a water deluge but a deluge of vanishing money or credit. That's why economists can't still get a handle on economic depression because they can't see something that disappears.

With this dam analogy, we can now understand the danger of deflation. Deflation, using the dam analogy, means that the reservoir water level is dropping because the dam has started to crack and spring leaks. The right thing to do is to release water from the reservoir to ease the pressure on the cracked dam. But the penstocks, the pipes that channel water for irrigation or electrical generation, are faulty. The valves or the sluice gates that allow water to pass through the penstocks are stuck because the cracked dam has misaligned them. The act of releasing water is analogous in economics to the winners voluntarily cancelling the debts owed by the losers. If the winners refuse to write off, the debts will still disappear but the manner in which they disappear is steeped in antagonistic feeling that, carried to extremes, can result in blood-letting.

Policymakers and economists fear deflation because when prices fall, they believe that people will withhold spending hoping that things can be bought cheaply later. This is a crock of bull which assumes people have foresight as to future prices. The recent falls in oil prices have resulted in onshore oil tanks and offshore tankers being filled to the brim because the speculators believe that oil prices will start rising again. People's expectations are always rational, that is, from their own perspectives.

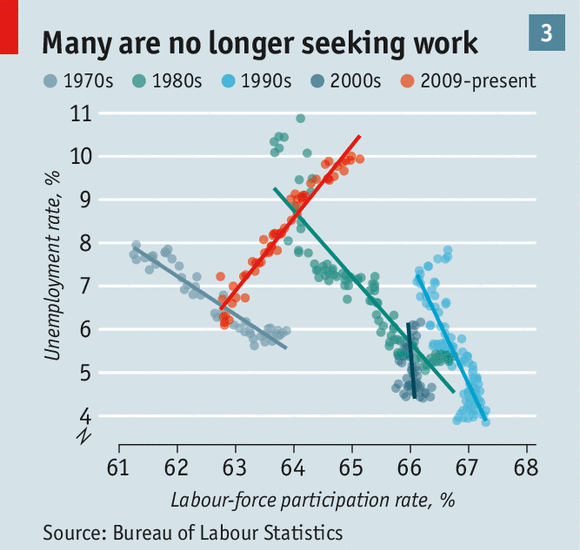

No, deflation is dangerous not because people withhold spending but because it signals that credit supply has begun its relentless slide towards a much bigger plunge, that is, the point when the dam bursts. People stop buying simply because they don't have money to buy. But the public loves deflation because it sees only lower prices; if it knows that lower prices come at the expense of losing jobs, it will clamour for inflation. Democracy thrives on the voters being continually deluded.

Credit disappears when wealth flows increasingly to the 1%. With disappearing incomes and wealth, the 99% can no longer repay their debts. That's why debt is dangerous in a deflation; delusionary economists however argue differently: in a deflation, the debt burden increases because debt maintains its value while prices of goods and service fall. If that's the case, borrowers can still cope by cutting other costs. One prominent economist, Paul Krugman, as usual with his specious argument, contended that we shouldn't worry over the high debt level because we owed it to ourselves. Of course, debt is not owed between people and animals but substitute 99% for 'we' and 1% for 'ourselves' and you'll get the drift of where events are leading up to.

Debts must be written off but it takes time for lenders to admit their losses. They would prop up their borrowers with more loans little realising that at the end stage of a Kondratieff Wave borrowers are losers who can never repay. The rise of big governments further complicates the issue. Imagine that in the Monopoly game the winner lends money to the bank to on-lend to the losers to keep the game going. The winner wouldn't lend directly to the losers because he knows that it won't be repaid. In real life, the government plays the same role as the bank in the Monopoly game. By taking on more debt from the 1% and dishing it out as incomes and welfare payments to the 99%, the government merely acts as a shock absorber to delay the inevitable reckoning. The effect is to make the crunch more catastrophic.

It's as if the dam operators upon seeing that the water level has dropped, remain oblivious to the cracked structure. They worry about the falling water level, not the cause of the fall. They carry out cloud seeding to increase rainfall to replace the leaked water. To assuage worries about the cracked structure, they make surface patching — that's what their QEs do — while underneath the cracks continue to build up. Western economic thought is like its medical counterpart: it treats symptoms rather than root causes.

As the water level keeps rising, the dam can no longer bear the pressure and eventually bursts. This is the trigger that marks the beginning of the depression. The gushing out of water and sudden great drop in the reservoir level is synonymous with the drastic falls in credit supply and goods and services prices as lenders are caught with loans that self-destruct. Money or credit suddenly vanishes. Prices are cheap simply because there's no money to be had.

That essentially is how an economic depression will unfold. Using the dam analogy, we can explain two issues: one, the events that are now playing out, and, the other, the plunge that is looming. This post deals with the first while the plunge will follow in the next post.

Now that oil prices have finally been devoured by the deflation monster, some commentators have welcomed the price falls as a boost to global economic growth while others fear the deflationary impact of lower oil prices. If you believed the former, you'd been disappointed by now as there are still no signs of robust growth after more than six months of prices falling from peaks of more than US$100 per barrel. On the other hand, if you worry about the latter, you can always offer to buy oil at US$100 from the Saudis. Alternatively, you can heed the equally crass advice of a former Harvard president to impose carbon tax on fuel. Mind you, the depression delusions don't spare those of high intellect.

These commentators are speculating on the consequences of the price falls. The mere thought of that betrays their delusionary thinking. If they can't grasp the cause of the price falls, their take on the consequences would surely be wide of the mark. A hint of the cause can be seen in the systemic nature of the price falls, affecting not only oil but practically all commodities. Commodity supply and demand being inelastic in the short term couldn't have risen or fallen so dramatically. Such vertiginous and expansive price movements within a short time span could only be caused by something that could easily expand and contract. The only thing that fits this bill is credit, a virtual object that can be created or erased at the stroke of a pen or a press of the key.

Although credit is the culprit for short term price gyrations, long-term price movements on the other hand are subject to technological advances. If we look at the long-term real prices of commodities (see chart below from The Economist), the trend is downwards. Eventually with new materials based on advances in nanotechnology, we will no longer have a need to move earth to exploit the minerals except gold and silver, which will remain in demand for their precious content. Most others will remain soundly buried.

We can also view the prices of the various industrial commodities (chart below from The Financial Times), this one from 2000 to 2014. Iron ore prices show more significant gyrations than the other industrial commodities but the trend is obvious: prices are plummeting across the board. Surely to understand this odd phenomenon, we can't be focusing solely on oil. The role of China in stockpiling certain commodities, especially iron ore and copper for its overbuilt cities, and the whole world for hoarding precious metals, i.e., gold and silver, may have accounted for the short-term differences in price movements but over the long-term convergence can be discerned.

Let's zoom our focus on oil, using the chart below from chartsbin.com. We have both real (constant) 2013 prices and nominal (current) prices of oil from 1861 to 2013. Notice over more than 100 years of oil being in use, its nominal prices had never exceeded US$10 per barrel. Only after the 1973 oil embargo did prices breached US$10 and only recently US$100. We are still in Wave 4 of the Kondratieff Wave that began in 1960 and will end by 2020. The second half of that period (1990-2020) should've been characterised by falling prices as winners begin grabbing wealth, preventing it from circulating through the economy. But that didn't happen although early signs did emerge with the puncturing of the Japanese property and asset bubbles. Abenomics is just the latest yet already failing attempt, after a slew of past equally failed measures, to break free from deflation.

If we exclude Japan, why have other countries not succumbed to deflation back then? If there were only two categories of economic players, that is, winners (1%) and losers (99%), the deflationary impact would've been felt much earlier. As explained earlier, the government, has been absorbing the blows inflicted by the winners, effectively delaying the onset of deflation. The wealth continues to circulate with the winners lending to the government who will in turn distribute to the losers. The chart below extracted from the McKinsey Global Institute report titled 'Debt and (not much) deleveraging' reveals how the public or government sector has been buttressing the global economy by taking on more debt after the 2008 Great Recession.

This arrangement works on the dubious assumption that the government will exist indefinitely. In the long span of history, much bigger empires came and went. Most of the developing nations now were created during Wave 3 (1900-1960) and the early part of Wave 4. But before Wave 4 even ends, many are starting to collapse with every passing month. Next in line beginning in Wave 5 (2020-2080) will be the developed nations as new technologies that favour pluralism start kicking in.

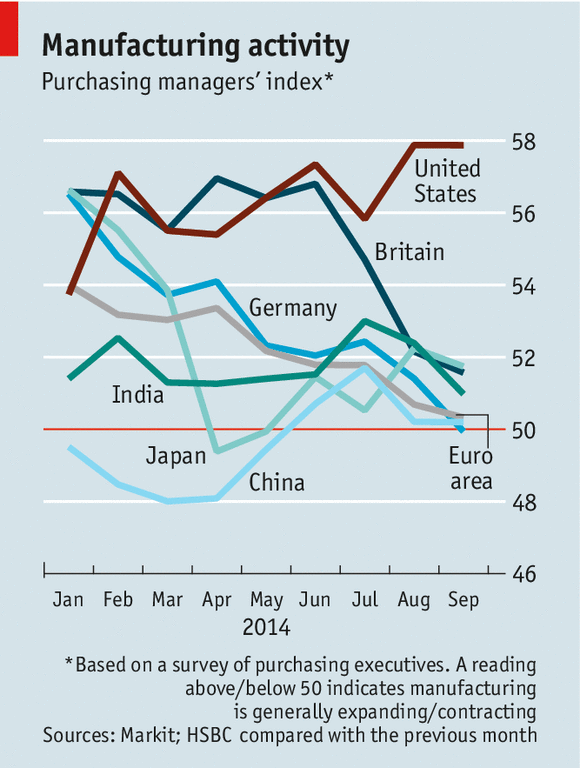

To see the impact of the above government debt or spending, we have the following deflation chart from The Economist that covers the same period as the second commodity chart and the debt chart above. Notice how deflation was discernable as far back as the beginning of the new millennium but the increased private debt that peaked in 2008 had rescued these high-income countries from the grip of deflation. The Great Recession wiped so much debt that deflation came back with a vengeance in 2009. The ballooning government debt managed to subdue the deflation but only for a couple of years. Now both the public and private sectors have overindulged on debt that they have been rendered powerless in the face of the deflation comeback. Also notice that the commodity prices in the second commodity chart were greatly influenced by the debt level.

Another bunch of high profile delusionary economists are the central bankers. They have been given undeserved credit for their supposed role in rescuing the global economy from depression. What they have done is only a sleight of hand trick which they themselves still are unaware. Now everybody is scared that they might raise interest rates which might scupper the so-called nascent recovery. The reality is the secular trend of the global economy won't be much affected even with the absence of the central bankers. The disappearance of credit won't be swayed by the tweaking of interest rates. Instead interest rates fall because money demand reduces as borrowers cannot afford to take on debt. They rise when investment opportunities abound during an economic expansion in the early half of a Kondratieff Wave.

Some economists have even joined the political fray, the most prominent being Yanis Varoufakis, the Greece finance minister whose specialty is in game theory. Well, his game theory is leading Greece into the abyss. The latest is he's planning to use Bitcoin, a currency that's as bad a choice as the Euro. He would understand money better if he had mastered the theory of the Monopoly board game. In the first place, when nation-states are fracturing, why does Greece want to remain in a confederation of nation-states which has passed its sell-by date? A state which has no control over its money has no control over its politics. Greece might as well offer to become Germany's 17th state. With one stroke, that would solve its war reparation claims and its cash crunch problem. What Hitler couldn't deliver, the Greece politicians are willingly proffering to the Germans. The Greeks must revive the drachma and exit the Euro which together with the EU are already in self-destruct mode.

When our metaphorical dam bursts, you will observe the economists will be the ones swimming naked. It takes an economic depression to make them realise that all along they've been wearing no clothes.