How do you run an economy in times of low growth? Do you keep on creating debts to artificially sustain the economy? The answer unfortunately can't be found by delving into the workings of modern economies. No, we don't have to go back far in time but just to industrial times though not in an industrial society. The time is 19th century and the society is the Kwakiutl tribes. To be sure, the Kwakiutl political and economic system is not perfect because we still have to contend with the human frailties of greed and self interest.

Politics and economics are intertwined. If only the anthropologists realised that economics is actually a study of human behaviours, they would have appropriated the university economics department as a sub-department within anthropology. Only then will economics be stripped of its pointless quantitative analysis that has blinkered economists for generations. Economics would also benefit from an interdisciplinary approach, avoiding the dangerous parochial mentality that ignores economics' inextricable links with other social science disciplines.

The narrative about the Kwakiutl that I'll recount in this post is nothing new. My sources are comprised of Daniel Gross's book,

Discovering Anthropology, Eric Wolf's

Envisioning Power: Ideologies of Dominance and Crisis and also several books by the late anthropologist, Marvin Harris. Some of the information can also be scoured from the web but knowing much is not important. The key is as Albert Einstein once said, "Any fool can know. The point is to understand." Admittedly, in the current crisis we've come across many charlatan economists proferring their quack remedies. To avoid becoming a fool, we will rely on our 4C framework to piece together the underpinnings of the Kwakiutl's social cohesion and economic well-being in the 19th century.

My previous post described how the Kwakiutl tribes — there were about 30 tribes, each in turn made up of clans or septs, all with their own chiefs — had managed to sustain their societal bond through their exhibitive wealth destruction as characterised by the potlatch ceremony. However there's more to it than just wealth destruction. More so with the crumbling of nation-states, when only those who organise themselves into tribes will stand a good chance of surviving the carnage that comes with the absence of a strong central authority — it's unravelling right now with the US retreating from global leadership just as one country after another descends into a fracturing mess.

Capitalism hastens this march towards disintegration as it falls over like a slowing bike when the economy is stuck in low gear. This low or zero growth prevails during the ending phase of a Kondratieff wave except that the current wave is significantly worse off than past waves. From the first to the third Kondratieff Waves, the ending phases were in the midst of increasing population growth rates. Although prices were dropping, the drops were compensated by increased consumption. But in the current fourth Kondratieff Wave, price drops take place in situations of slowing population growth rates, and in some countries, declining population numbers. The world in modern times has never encountered this phenomenon but the Kwakiutl did — because of western epidemics, their population plunged from 23,000 in 1836 to 2,000 in 1886, this being a major setback which they weren't able to recover from. Economists who have observed the beneficial price deflation of past Kondratieff waves fail to appreciate that, given this population reversal, the past experiences of the western economies are a misleading guide to the future.

The Kwakiutl narrative is about economy, money and wealth — its accumulation, circulation and destruction. What stood the Kwakiutl apart is that they managed to accumulate wealth without creating the extreme inequality that afflicts modern capitalism. Of course, like those of most traditional societies, their economic system was not capitalism; theirs was more of a gift or reciprocity economics.

The environment in which they lived played a major role in how they organised their lives. That environment, the Pacific Northwest coast (see Wikipedia map below) of Northern America, was a rich source of food, chiefly attributable to the genial climate and the conducive physical geography. How they adapted to that environment is the crucial point.

From the map, you will notice that the coastline is rugged and studded with islands and intersected by many river and stream inlets. The communication leg of the 4C is evinced by the numerous waterways linking the land. Physically, the natural nook and crannies of the landscape are ideal grounds for the proliferation of many species of fish and shellfish while the dense forests provide timber and various game animals; this being the capacity leg of our 4C. Now, if we flatten the land and straighten the coastline, that would correspond to globalisation in the economic sense. It would destroy all those niches in the name of economic efficiency. The outcome is immediate bounty enjoyed only by the top predators followed by long-term paucity as species diminish with fatal consequences to the predators themselves.

The Pacific Ocean to the east is warmed by the Alaska current, which flows northward. This warming moderates the cold climate and generates heavy year-round rainfall which contributes to the thick forests. The Kwakiutl's canoes and houses were built from the red cedar timber while their clothing from its bark. They also gathered various types of berries and roots from the forests and kelp and seaweeds along the shore. Their primary occupancy was however fishing. From the sea, they caught seals, seal lions, codfish and halibut while from the rivers, salmon. The salmon runs were so heavy that a person could catch enough fish to last one year just by fishing for a few days. As food was seasonal, the Kwakiutl would fillet and dry or smoke the fish for later consumption.

Every Kwakiutl clan had its own fishing spots, hunting grounds and berry-picking grounds. These sites were under the custodianship of the clan's chief. That was how order was maintained among tribe members. When the economy can't expand, you have to stop competing and start cooperating. Moreover, although the land was bountiful, the Kwakiutl could at times be exposed to starvation as food resources were not constant from year to year. The potlatch was the means to redistribute the sometimes unequal harvests. The potlatch didn't interfere with their economic activities as it was held in winter. In fact it spurred them to work harder to accumulate in spring and summer what had been destroyed in winter.

We can observe in modern times that the surplus production of resources would lead to wealth accumulation but, as we all know, whenever wealth is allowed to accumulate, wealth distribution will inevitably be unbalanced. The lopsided wealth accumulation usually favours those who are born of the right lineage. Meritocracy has conveniently been used by the haves to reinforce their status difference, feigning ignorance to the fact that not only status privileges confer head-start benefits upon birth, such benefits also swell with the progress of time, eventually reaching extreme proportions.

Even in Ancient Rome during its golden age under Emperor Augustus, members of the upper classes which controlled most of the agricultural land made up only 1 percent of the population. This is no different from the current politics in the US where leaders from both sides of the political divide are beholden to the 1 percent. The 1 percent is always successful throughout the ages because, to quote Joseph Brodsky's observation, "life is a game with many rules but no referee." Those who win don't consult the rules to see what's right or wrong. Instead they watch others play to see what works. Often they inherit substantial wealth which they use not only to leverage their competitive positions but also to write or bend the rules.

That explains why countries which have sought to transfer wealth through redistribution in order to achieve social harmony, have achieved disappointing results. The gap between the haves and the have-nots continue to widen as wealth eventually ends up with the haves. Often, ethnicity is the dividing line. It's not at all surprising that WEB Du Bois, the late African-American sociologist once lamented, "To be a poor man is hard, but to be a poor race in a land of dollars is the very bottom of hardships." It's not easy to escape the clutches of a weak culture when stacked against it is a more competitive culture that keeps on outpacing it. The competition is not between individuals but between cultures, with the stronger culture buttressed by its closely knit network.

To the politicians, this is their biggest dilemma: To redistribute wealth creates social rifts but not to do so threatens a social collapse. It becomes more problematic with the onset of globalisation as wealth redistribution would make a country's economy inefficient relative to that of another with no such programme. But in the early phase of globalisation, everybody benefits as even those who lose out can resort to credit to buy cheap goods. It's in its later phase that the dark reality sinks in. Now the horrendous cost of globalisation is mounting as one country after another plunges into social turmoil with seemingly no end. Economics, not the voters, is the real lever behind politics as politicians take turns at being elected and booted out. Both politicians and voters are confounded by this turn of events. Blaming globalisation is out of the question as this goes against received wisdom.

The tenacious reluctance of wealth to redistribute itself has been given further credence by a recent op-ed piece '

Your Ancestors, Your Fate' in

The New York Times which estimates that 50 to 60 percent of variation in overall status is determined by your ancestors. Worse, it takes 300 to 450 years for the fortunes to significantly change. This gives the lie to the popular maxim that "all men are created equal." A recent book titled

Capital in the Twenty-First Century by Thomas Piketty, a French economist, also claims that wealth inequality rises exponentially. Actually, you don't have to carry out deep research to make such a claim; a round of the Monopoly game would leave you convinced. Recognising pattern is a quick way to understanding events and issues.

If social mobility moves at a glacial pace, we might as well embrace the Kwakiutl's customs of institutionalising status difference through ranking. At least life is more stable and predictable as this obviates the need to individually outdo others. In pack animals that have a number of both males and females, such as wolves, only the leaders, the alpha male and female, have elevated levels of cortisol, a stress hormone, a consequence of always needing to be on guard against a leadership challenge by the pretenders, the beta male or female. A lower ranking member has no reason to go for the leadership of the tribe as he/she will not be accepted as a legitimate leader by the tribe members.

While we may think that our own life experiences belie this, bear in mind that most of us have benefited from the industrialisation advances of the 1st to the 3rd Kondratieff Waves and these are being undone by the intellectualisation advances of the 4th to 5th Kondratieff Waves which are dumbing down jobs. The wealth from industrialisation has led to the demise of the extended family and the proliferation of nuclear family that is detached from near relatives. The same wealth has allowed the state to provide the bond that glues together a modern society.

However, this situation is unravelling as the middle class is being hollowed out by advances in computing and artificial intelligence that have eliminated jobs even in fields previously considered unthinkable, such as research analysis and writing. Jobs exist only in the lowly paid service sector. Now even those who find it below their dignity to depend on the state would readily accept state handouts. The state will weaken and eventually die out with the disappearance of the middle class.

The European Dark Ages (AD 300 to AD 700) that followed the fall of the western Roman Empire coincided with the Little Ice Age in which agricultural yields fell, wiping out the surplus that had been used to support urban life. Likewise with the coming end of the Kondratieff Waves, the security of law and order provided by the state will vanish. Banding together into tribes is the only means of coping with future troubles. Troubles will not only come from other tribes but more dangerously from individuals who will be increasingly empowered as a destructive force by advances in computing, nanotechnology and biotechnology.

Tribes are structured differently in different societies but since we mostly come from wealth accumulating societies, the Kwakiutl structure may be insightful. A Kwakiutl society had four rankings: chief, noble, commoner and slave. Slaves were mainly war captives, captured through night raids on rival tribes or villages, but they could also be traded. Although slavery seems morally repulsive, we must remember that slavery was prevalent in ancient societies. The main reason we can live without slaves is because technological advances have replaced the biological muscles of slaves. Soon technology will enslave us as we will be in thrall to those who possess vastly superior technology.

Owning slaves was not only a means of flaunting a family's wealth but slaves also reinforced the Kwakiutl's wealth differences as slaves enabled the Kwakiutl chiefs to possess more productive capacity in a society with no draught animals and labour saving technology. Both flaunting wealth and increasing wealth disparity are, in fact, common features shared by all societies in which wealth accumulation is the norm.

Wealth accumulation entails money or, more specifically, credit. Within a tribe, there was no need for money in the absence of market exchange among themselves since the members were all producing the same goods. It is said that barter was used when trading with other tribes or with European settlers. However, it is more likely that the Kwakiutl and other North American tribes used physical objects as money to conduct trade with outsiders.

The money used was initially dentalia, that is sea shells of a mollusk species that were harvested on the coast of Vancouver Island. Later, the Hudson's Bay wool blankets replaced dentalia as currency. Dentalia and wool blankets could serve as money because they fulfilled two key requirements: credibility and liquidity. Credibility because both had intrinsic value: dentalia as jewellery and ornaments, and wool blankets as robes for the loinclothed or breechclothed Indians. Wool blankets could hold heat even when wet. Liquidity means that the supply of both currencies could increase but not too fast so as to easily lose their value.

Sometimes, credibility comes from general acceptance by members of the tribe on the historical value of the chosen money even though it has no inherent value. The Yap islanders in Micronesia at one time used doughnut-shaped stone discs as money. Because the discs are heavy, ownership might change without any physical movement of the discs. This is possible only in small traditional societies because of the high trust, fostered by blood relationships, among members.

Confused observers have treated the exchanges carried out using physical objects as barter. So they have assumed that before the advent of money, man resorted to barter. They couldn't have been further from the truth. A look at the trade involving dentalia would reveal that barter cannot substitute for money. In trading with the Kwakiutl, the white settlers would keep dentalia that they had received in exchange for guns and copper plates. The dentalia would then be used to buy otter pelts or other tradeable goods from other tribes. The exchange was not between pelts and guns but between dentalia and other goods.

And most important, when trade was between tribes, current account deficits or surpluses, the bane of a country' economy, did not arise; all trades were settled in full. You don't extend credit to other tribes when you can't enforce repayment. When the global economy is growing, it's normal for some economies to suffer deficits and others to accrue surpluses but when growth is flat, all countries must square accounts among themselves. Otherwise extreme deficits will crush a country's economy and with it, its political stability.

Our modern paper or fiat money, like the Yap stone money, also has no intrinsic value but depends on the strength of the state for credibility. It is said that value can be imputed to fiat money by the state imposing tax, payable in fiat money, on its citizens. However there are states with zero taxation yet having its own fiat money. Usually the state relies on exports of high value natural resources for income. So the credibility of fiat money doesn't come from taxation but from the economic and political strength of the state. The moment the state fractures, the value of its fiat money disappears along with it. That's why in the future, we can expect fiat money to vanish.

The more important money however is credit because without credit, you can't accumulate wealth on a big scale though you still need physical object or paper money in which to reckon credit. Credit also needs written accounting records and a strong written rule of law. However for tribes, an oral record made known to all tribe members is the custom. The potlatch serves this purpose because most members of the competing tribes would witness the debt. The purpose of the record, written or oral, is to ensure that the debtors honour their debts or risk dishonour.

Credit is the easiest money to create but it's preconditioned on the existence of trust. Although trust within a tribe is huge, internal market exchanges that give rise to credit are rare. So how did credit emerge in Kwakiutl tribes? Their potlatch ceremonies created a need for debts because the organisers had to amass goods to be given away. They did this by forcing loans on the tribe members to induce them to contribute. Also, the potlatch gifts that were made to a chief were expected to be repaid with an interest payment. But repayment is not an obligation; if you couldn't repay, there was no debt slavery, you just suffered shame. Some potlatch goods were not even given away but destroyed just to show that repayment was not desired. This need to cancel debts and let debtors off would have been of great benefit to modern society in times of low growth as it would check the rapidly rising inequality.

Before 1849, the potlatch ceremonies were small scale and the gifts were of low value. The change post-1849 came about after some of the tribes merged into a bigger coalition. Warfare and slave raiding diminished and to make up for that, the potlatch ceremonies took on a grander scale. Slaves as a source of wealth no longer mattered as the Kwakiutl had access to the money economy of the Europeans. Because ranking remained highly esteemed in tribes, the potlatch now took on the role previously elicited by warfare, that is, a means of projecting a tribe's status over other tribes. If a chief could outdo others in giving away more wealth, then his status and that of his tribe would rise.

As the potlatch grew in scale, the social hierarchy of the Kwakiutl was being insidiously threatened by the money economy. Each Kwakiutl tribe used to have its own subsistence area and seasonal sites under the control of the hereditary chief. By controlling the means of economic production, the tribe chief gained submission over his followers. But with more economic opportunities available outside from employment in the money economy, the chief's economic hold over his followers began to weaken. Once exposed to the money economy, the fortunes of the Kwakiutl tribes would rise and fall along with that of the general economic cycle.

Although the Canadian government outlawed potlatch in 1884, the decline in potlatch ceremonies could have been precipitated by the great decline in the Kwakiutl population. By then the potlatch was not only a means for giving away goods but also a contest for destroying great amounts of property. Destroying money, burning blankets and canoes, breaking and throwing copper shields into the sea, and burning fish oil in which the fire would reach to the roof were carried out not only to demonstrate great wealth but also as a sign of a society demoralised by the dwindling population. It could also reflect that the goods were surplus to the needs of the reduced population and thus had to be destroyed.

The eventual cause of the cessation of the potlatch was the the Great Depression of the 1930s. As more Kwakiutls got caught in the money economy, their fortunes flowed and ebbed with that of the economy. As the Great Depression struck, many couldn't afford to pay off their debts and accumulate enough wealth to redistribute. Nowadays, the potlatch is still held but more for their symbol of a native identity and tradition.

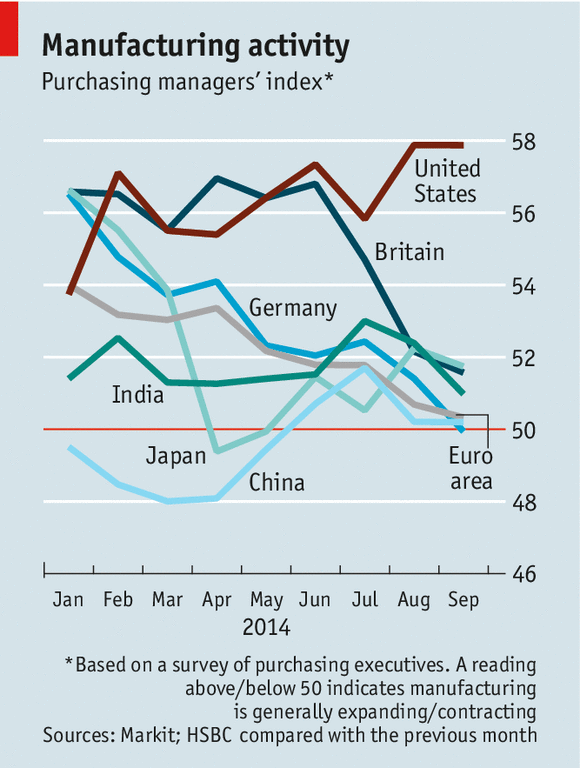

Much

has been said or written about the growing US economy in the midst of a

retrenching global economy. How things have changed. At one time, China

was thought to be the growth engine. Now it's switched position with

the US. There's no better depiction of the state of the major economies

than the HSBC/Markit Manufacturing Purchasing Managers' Index (at left,

from The Economist). It may be argued that manufacturing is a

minor component of a modern economy but still it provides an advance

indication of economic conditions since months before the products are

consumed, orders for raw materials would have to be placed. The

purchasing managers therefore would've had advance knowledge from their

sales teams about future consumer demand.

Much

has been said or written about the growing US economy in the midst of a

retrenching global economy. How things have changed. At one time, China

was thought to be the growth engine. Now it's switched position with

the US. There's no better depiction of the state of the major economies

than the HSBC/Markit Manufacturing Purchasing Managers' Index (at left,

from The Economist). It may be argued that manufacturing is a

minor component of a modern economy but still it provides an advance

indication of economic conditions since months before the products are

consumed, orders for raw materials would have to be placed. The

purchasing managers therefore would've had advance knowledge from their

sales teams about future consumer demand. The seeming growth in the US economy in times of falling growth elsewhere can only be explained if we look closely at its credit growth. Under current conditions when wealth circulation is about to seize up, you can have growth only if you juice up credit growth. This does not tackle the crucial problem of failing wealth circulation, it just lets the problem fester much longer at the risk of more serious consequences later. If we look at the US 2nd quarter 2014 GDP, we can see it perked up, only slightly. We should not use the widely reported 4.6% quarter on quarter growth compounded 4 times, because the true measure is the 2.6% year on year growth. You can see that credit did move up and so did GDP but overall the movement was insipid. Next we need to know which credit component caused the slight uptick in credit.

The seeming growth in the US economy in times of falling growth elsewhere can only be explained if we look closely at its credit growth. Under current conditions when wealth circulation is about to seize up, you can have growth only if you juice up credit growth. This does not tackle the crucial problem of failing wealth circulation, it just lets the problem fester much longer at the risk of more serious consequences later. If we look at the US 2nd quarter 2014 GDP, we can see it perked up, only slightly. We should not use the widely reported 4.6% quarter on quarter growth compounded 4 times, because the true measure is the 2.6% year on year growth. You can see that credit did move up and so did GDP but overall the movement was insipid. Next we need to know which credit component caused the slight uptick in credit.