We don't want to revisit the legacy of both leaders; that would be the job of historians. Indeed they were truly admirable. But were there to be a leader of similar ability, could he or she reach the great heights of global stature especially in these trying times? Or was there something else about Reagan and Thatcher that has yet to be made known to us, the gullible public?

With the benefit of hindsight and a vast treasure trove of information on the web, we can now reexamine the reasons behind their prominence from the perspective of the 4C (see "Reality in 4C"). You should have been aware by now that Reagan secured his second term by paying homage to the credit market. But let's get into the details to debunk the conventional wisdom surrounding Reagan first, to be followed by Thatcher in a future post.

We begin with the tax and spending cuts, two issues frequently cited by the Republicans to justify their calls for similar action by Obama. When Reagan came into office in 1981, he reduced the top marginal tax rate from 70% to 50%, and federal spending by almost 5% of the federal budget. However this step could only last one year as coupled with Volcker's high fed funds rate that topped 19%, the economy was plunged into a recession (see left chart from The New York Times). The fall in inflation rate following Volcker's tight money policy accentuated the fall in the tax intake. So Reagan had to reinstate the tax revenue in 1982 not by reversing course but by transferring the burden onto businesses. Still, his tax cuts were much more than the increases; by the end of his administration the top marginal rate was further reduced to 28%.

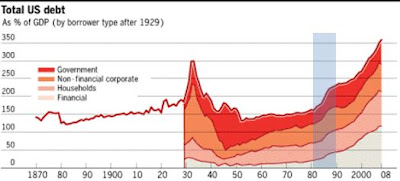

The result of the tax cuts was reflected in the ballooning federal deficit, tripling from US$900 billion to $2.7 trillion by the end of his administration (blue column on the left chart). However this deficit actually boosted the economy. It supplied the spending and liquidity that uplifted the incomes of households, businesses and foreign nations. In turn the businesses and households took on higher borrowings of their own, resulting in a spike of total US debt that started from the end of Reagan's first term.

The result of the tax cuts was reflected in the ballooning federal deficit, tripling from US$900 billion to $2.7 trillion by the end of his administration (blue column on the left chart). However this deficit actually boosted the economy. It supplied the spending and liquidity that uplifted the incomes of households, businesses and foreign nations. In turn the businesses and households took on higher borrowings of their own, resulting in a spike of total US debt that started from the end of Reagan's first term.He gained much from the cautious policies of his predecessors. Not only were they conservative with deficit spending but the inflationary conditions that had characterised their presidencies reduced the relative level of the federal debt. For example, Carter increased the federal debt by about 30% but because of the inflationary condition, the debt/GDP ratio actually decreased by 3.3%. Reagan's two terms however marked a new era of debt financing, not only by the government but also by the other sectors: businesses and households. Reagan took advantage of the depressed borrowings of the earlier years to let rip the borrowing and spending spree.

Also, unlike Nixon, Ford and Carter, Reagan didn't have to endure periods of high inflation, commonly known as stagflation because of the stagnating GDP. Milton Friedman used to remark, erroneously in fact, "Inflation is always and everywhere a monetary phenomenon." It should have been a 4C phenomenon instead of only a monetary phenomenon. The other important factor is capacity in which oil plays a very significant role as the driver of virtually all economic activities.

Remember that oil prices started to experience wild swings following the 1973 OPEC oil embargo. In fact, the sudden jump in prices wasn't totally unexpected had the buyers observed the declining spare capacity leading to the embargo (see "Oiled for Turmoil"). But as new oil fields took at least 7 to 10 years from initial exploration to production, it wasn't until the early 1980s that these fields managed to boost the spare capacity. However the 1979 Iranian Revolution followed by the Iran-Iraq War in the following year further scuttled oil production leaving the Carter administration wondering why his increased spending didn't translate into higher economic growth instead of higher inflation.

Only in 1985 did the prices drop to US$26 per barrel and by the following year to as low as US$11. Until the end of Reagan's second term the prices remained favourable, hovering around US$20. So Reagan could have the cake and eat it too, his spending going straight into the consumers' pockets instead of the oil producers'. Production capacity could increase to take care of the spending when previously any increase was constrained by higher input costs.

These two factors explain why no one else can repeat Reagan's feat and why there is so much yearning for Reagan's leadership. Although oil prices will likely go down as vast new fields in North Dakota, Colorado, North Sea, Colombia and Brazil's coastal waters come onstream in the next couple of years, the debt could no longer be increased. It has reached the peak of the S-curve and the only way forward is down. Those who want to spend no longer have the income to afford the debt while those who have the means have no use of further borrowings.

Poor Obama, intelligence alone is not enough to guarantee good leadership. More important is the external environment which in these troubled times can do far more to make or break a leader.

No comments:

Post a Comment